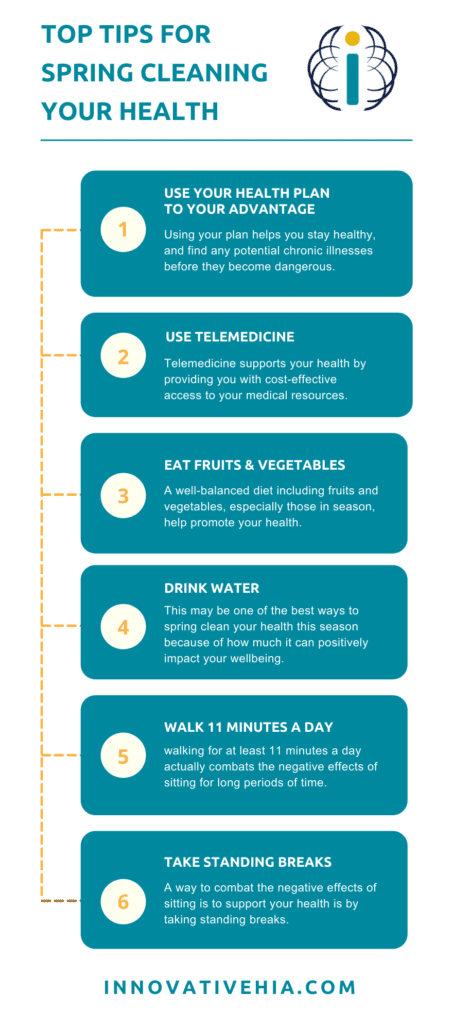

Spring is in the air. This means it’s time to spring clean not only your home but also your healthy habits. By focusing on simple ways to improve your health, you are setting yourself up to take advantage of lifelong health benefits. Implementing healthy habits is simpler than you’d think.

Use Your Health Plan to Your Advantage

Your health plan is a resource to be used to your advantage. Using your plan helps you stay healthy, and find any potential chronic illnesses before they become dangerous.

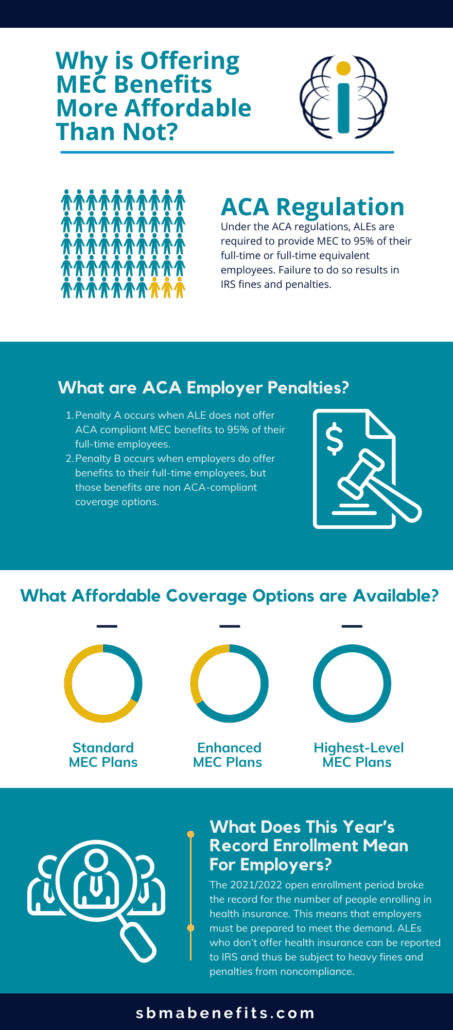

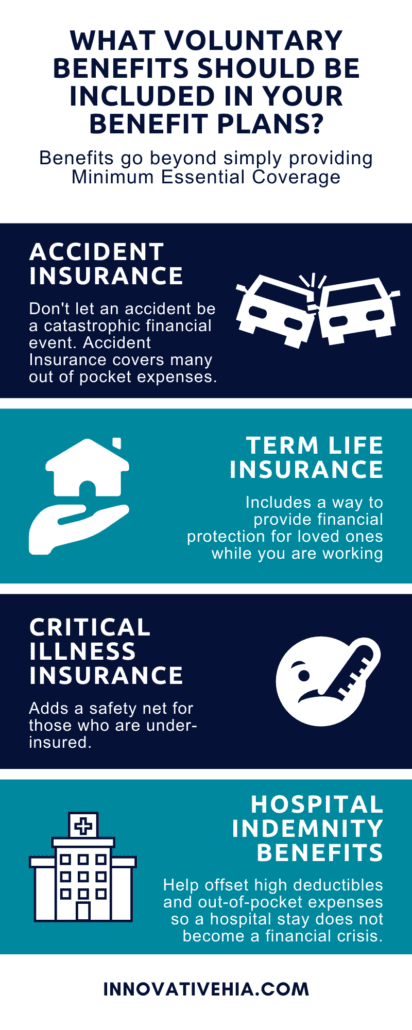

Basic health insurance plans, like Minimum Essential Coverage plans, include ACA-compliant services that cover wellness, preventative services, prescription discounts, and telehealth services.

How can you use your health insurance to spring clean your health?

First, visit your primary care provider. Plans offer coverage for an annual checkup with your primary care physician. This annual checkup helps keep you and your healthcare team ahead of potential chronic illnesses by catching a diagnosis early. This visit allows your provider to consistently monitor your health year after year. Anything found during this visit can be addressed and monitored before it becomes more serious.

Next, use your plan to cover routine vaccinations. They protect your body and keep you strong against viral and bacterial illnesses. It helps you reduce the risk of contracting disease or spreading disease.

Your health plan may offer prescription discounts that make medication more affordable. If your healthcare provider prescribes a medication, stay healthy by taking your medication as directed, and save money in the process.

Lab work and screenings act similarly to your annual physical. If the lab work or screenings flag your doctor of potential illness, catching it early can help you stay healthy, longer.

Use Telemedicine Services

Telemedicine supports your health by providing you with cost-effective access to your medical resources. Oftentimes, telehealth copays are less expensive than an office co-pay.

Use telehealth as an opportunity to speak with your health care team regarding:

- Medical test results

- Lifestyle coaching

- Health coaching

- Consultation visits

- Medication management

- Chronic disease management

Patients receive the same quality of care with telehealth visits as they do in a provider’s office. Taking advantage of telemedicine services supports your health, reduces time spent at the doctor’s office, and saves money. Learn more about the top reasons why you should use telehealth here.

Eat Fruits and Vegetables

A well-balanced diet including fruits and vegetables, especially those in season, help promote your health. A few of the positive effects they have on your body include:

- Lowering blood pressure

- Reducing the risk of stroke

- Cancer prevention

- Reduce digestive issues

- Support your vision

- Promote weight loss

- And more

Easy ways to add fruits and vegetables into your daily diet are by keeping them where you can see them, and by incorporating them into a meal itself (i.e. soups, salads, and stir-fries).

Instead of turning towards a sugary treat after a meal, try an in-season fruit. It’ll satisfy your sweet tooth and support your body’s overall health simultaneously.

Curious if the foods you think are actually healthy for you, are? Take our quiz here to find out if the foods marketed as “healthy” are actually good for you.

Drink Water

Oftentimes, the answer seems to be “drink more water.” This may be one of the best ways to spring clean your health this season because of how much it can positively impact your wellbeing.

At a basic level, water helps your body function by:

- Eliminating waste through urination, and perspiration

- Temperature regulation

- Lubricating and cushioning joints

- Protecting sensitive tissues

Dehydration can lead to fatigue and a reduction in your body’s ability to perform the way it needs to.

Other ways water supports your health is through:

- Supporting brain functions

- Supporting your kidneys

- Aiding with digestion

- Promoting clearer skin and skin elasticity

How much water should you drink a day? According to The U.S. National Academies of Sciences, Engineering, and Medicine men should drink at least 15.5 cups a day and women should drink at least 11.5 cups a day. One way you can increase your liquid intake is by swapping out sugary drinks for water. Your body will thank you for it.

Walk 11 Minutes A Day

Ideally, physicians recommend at least 30 minutes of moderate physical activity each day. Unfortunately, the increase in more sedentary lifestyles hinders the amount of physical activity people take daily. Forbes found that the average stay-at-home employee sits for about 15 hours a day.

Sitting for the majority of the day has detrimental effects on the body. In fact, the Mayo Clinic analyzed 13 studies and found that all found, “sitting time and activity levels found in those who sat for more than 8 hours a day with no physical activity had a risk of dying similar to the risks of dying posed by obesity and smoking.”

A way to combat the negative effects sitting has on your health is by taking at least an 11-minute walk a day. The positive impact it has on your health is lifelong according to a study by the British Journal of Sports Medicine. They found that walking for at least 11 minutes a day actually combats the negative effects of sitting for long periods of time.

Take Standing Breaks

As previously mentioned, sitting for long periods of time has detrimental effects on your body. Its impact is so great that it is now coined “the new smoking.”

A few ways it hurts your body is through:

- Leading to weight gain

- Muscle loss

- Links to lung, uterine, and colon cancer

Learn more about the long and short-term effects here.

A way to combat the negative effects of sitting is to support your health is by taking standing breaks. Ways you can do this is through:

- Standing while working

- Walking during meetings

- Taking movement breaks

- Stretch during the day

- Take walks

- Set timers to move around

A Final Word

Spring clean your healthy habits by implementing these habits. Together, they have a lifelong impact on supporting your overall wellbeing. For more healthy habit tips, read our article giving tips on using your health insurance to meet your health goals.

Article originally published on SBMA Benefits.