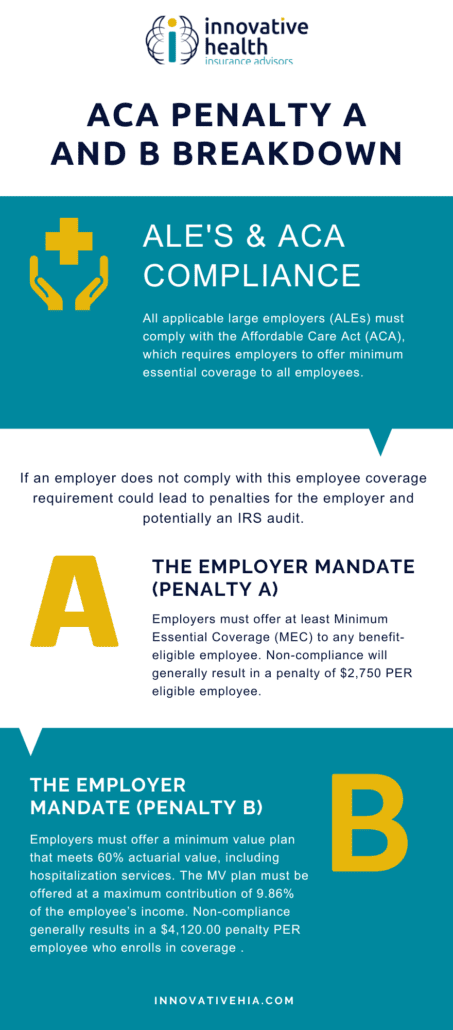

The Affordable Care Act (ACA) has a number of different mandates and regulations, which can carry hefty penalties if you don’t comply. If you receive an ACA penalty, it’s important to understand what to do in order to minimize the impact of this financial burden. In this blog post, we will discuss the types of ACA penalties that you may face, as well as how to navigate the process of dealing with them. We will also provide tips on how to avoid ACA penalties in the future.

If you are a business owner trying to remain compliant, this blog post will help you take the necessary steps to stay up-to-date with your obligations under the ACA and avoid costly penalties in the future.

What are Some Reasons Why a Business Owner Could Receive an ACA Penalty?

There are a few reasons why a business owner may receive an ACA penalty:

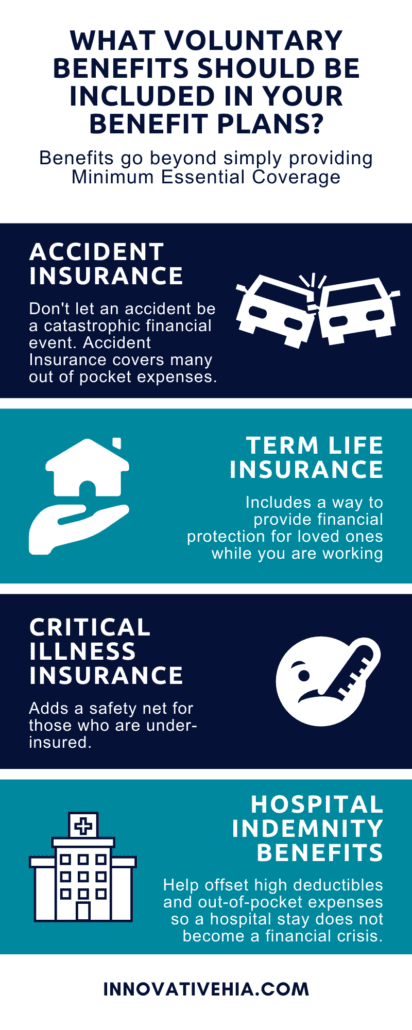

- Not Offering Qualified Health Insurance Coverage – The employer mandate requires employers with 50 or more full-time employees provide qualified health insurance coverage to at least 95% of their full-time employees. If a business fails to offer this coverage, they may be subject to an ACA penalty.

- Not Providing Affordable Coverage – Employers must also provide affordable coverage to at least 95% of their full-time employees. If the employer fails to meet this requirement, they may be subject to an ACA penalty.

- Failing To Offer Dependent Coverage – The ACA requires employers to offer dependent coverage up to the age of 26. If an employer fails to provide this coverage, they may be subject to a penalty.

- Not Adequately Reporting ACA Information – Employers are responsible for accurately reporting employee health insurance information on their taxes and other forms. Failure to do so can result in an ACA penalty.

- Offering Coverage to Employees Who Are Not Eligible – Employers must also make sure that all of their employees who are eligible for coverage are offered coverage, or else they may be liable for an ACA penalty.

- Failing To Comply With State Regulations – Some states have their own requirements when it comes to providing employee health insurance. If a business fails to comply with these regulations, they may be subject to an ACA penalty.

No matter what the reason, it is important for employers to understand their obligations under the ACA so that they can avoid penalties. By understanding the law and taking steps to ensure compliance, employers can avoid costly ACA penalties.

By following the guidelines set forth by the ACA, employers can ensure that they are compliant and avoid having to pay unnecessary penalties. It is important for businesses to stay up-to-date on all of their responsibilities under the law in order to remain compliant and avoid costly fines or penalties. Employers should consult with an experienced attorney or tax specialist to ensure that they are in compliance with the ACA.

The consequences of not complying with the ACA are serious. Business owners should make sure that they understand their responsibilities and take steps to ensure compliance in order to avoid costly penalties or fines. An experienced attorney or tax specialist can help business owners stay up-to-date on all of their obligations under the law.

Additionally. . .

There are many other reasons why a business owner may receive an ACA penalty, and it is important to understand them in order to avoid them. Consulting with an experienced attorney or tax specialist can help employers understand the law and ensure that they remain compliant. By doing so, businesses can avoid costly penalties while providing quality healthcare coverage for their employees.

The Affordable Care Act is a complicated law and understanding it can be difficult. However, by taking steps to make sure that they are compliant with all of the provisions, employers can avoid costly penalties and fines. By consulting with an experienced attorney or tax specialist, employers can make sure that they remain compliant while providing quality health care coverage to their employees.

By understanding their obligations under the ACA, businesses can ensure that they remain in compliance and avoid any unnecessary penalties or fines. With the help of an experienced attorney or tax specialist, businesses can make sure that they are up-to-date on all of their responsibilities under the law and remain compliant with the ACA.

What to Do if You Receive a Penalty

If you’re a business owner and have received an ACA Penalty from the IRS, take the following steps:

- Contact your tax advisor. Your tax advisor should be able to provide advice about how to proceed with this penalty and whether it can be appealed or reduced in any way.

- Review your employee records. The penalty could be the result of incorrect or incomplete information about your employees, so make sure all records are up-to-date and accurate.

- Determine how you’ll pay the penalty. You may have to pay the penalty in a lump sum or over several payments, depending on how much is owed.

- Contact the IRS to discuss payment options. The IRS may be able to assist you in setting up a payment plan for paying the penalty, or they may be willing to work out an alternative arrangement.

- Establish a compliance program going forward. Once the penalty is paid and any necessary documents are filed, it’s important to ensure your business is compliant with the ACA going forward. Work with your tax advisor or another specialist to set up a compliance program that will help you avoid penalties in the future.

- Appeal if necessary. If you feel the penalty was issued incorrectly or unfairly, you can appeal it by filing an application for reconsideration with the IRS. Your tax advisor can help you determine if appealing is a viable option for your situation.

By following these steps, you can ensure that your business is compliant with the ACA and any penalties are handled appropriately.

In Summary

The key to avoiding future ACA Penalties is understanding how the law applies to your business and making sure all of your employee records are accurate and up-to-date. Additionally, establishing a compliance program and regularly reviewing your employee records is essential to avoiding future penalties. Finally, be sure to contact the IRS if you receive a penalty and consider appealing it if necessary. With these steps in place, you can help ensure that your business remains compliant with the ACA going forward.

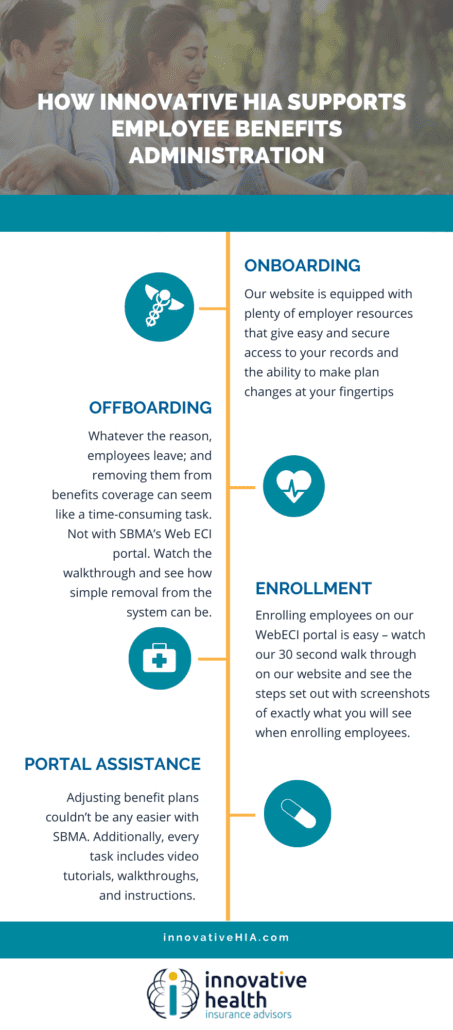

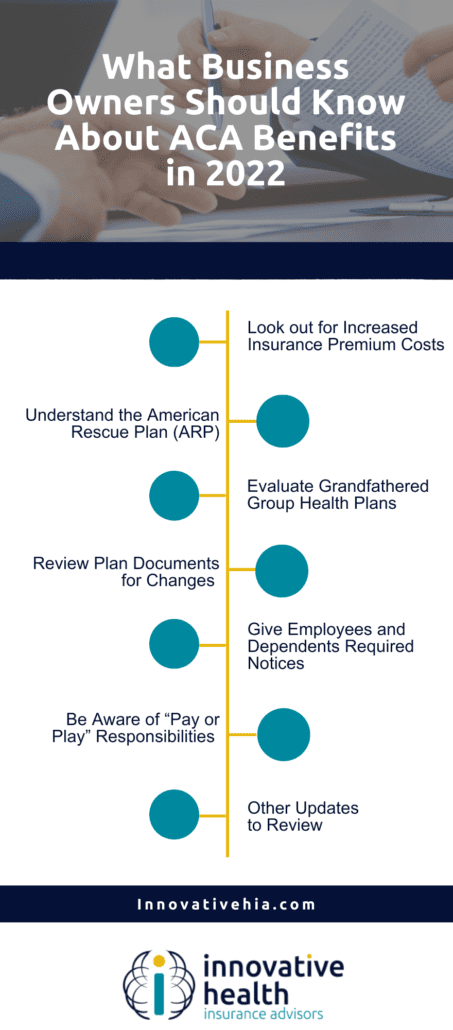

By taking steps to make sure that their business is complying with all of the provisions of the law, employers can avoid costly penalties and fines. The best way for employers to make sure that they remain compliant is to consult with a professional like our team at Innovative HIA, who understands the ACA and can help them stay up-to-date on any changes to the law.