Applicable Large Employers (ALEs) are businesses that have at least 50 full-time, or full-time equivalent employees in one calendar year. Under federal law, they must provide at least 95% of their employees and their children up to age 26 with Affordable Care Act (ACA) compliant coverage.

Why? Because the ACA was designed to make healthcare services affordable to more people.

Businesses that are considered ALEs that fail to meet ACA requirements will end up paying fines and penalties by the Internal Revenue Service (IRS). These fines can range from $300 – $4000 per employee who is not offered ACA compliant benefits.

Minimum Essential Coverage (MEC) is one of the most comprehensive and affordable ACA-compliant plans employers can provide to their workforce. Basic benefit plans meet the minimum ACA requirements while simultaneously supporting a healthy workforce.

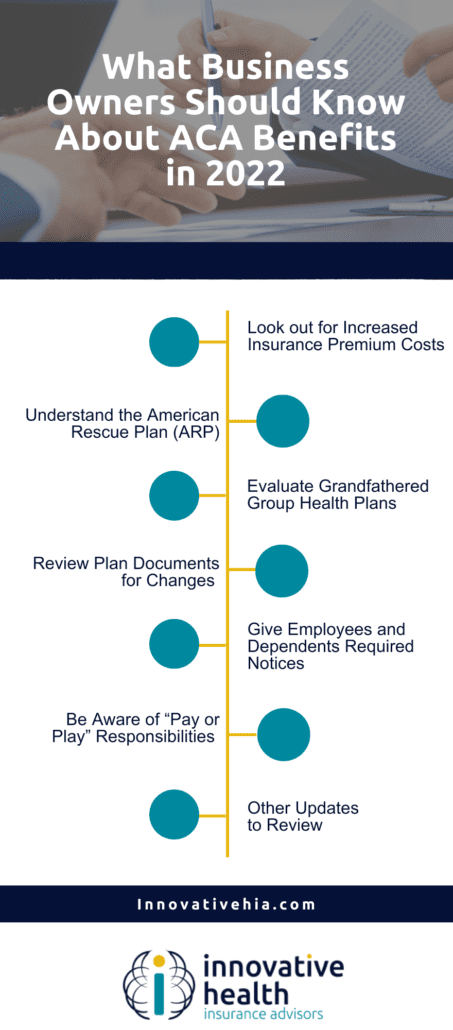

As we look to the next year, it’s important to understand how changes in insurance and federal law may affect their ACA compliance. What does a business owner need to look out for in 2022 to remain ACA compliant?

Look out for Increased Insurance Premium Costs

First and foremost, health insurance premium costs are increasing for business owners this year. The baseline for affordability percentage, or the maximum percentage of an employee’s income they can contribute to their employer-sponsored self-only coverage, has lowered, therefore there is a greater cost to the business owner.

In 2021, the affordability percentage was 9.83%, however, the threshold for 2022 is decreased to 9.61%.

What does this mean for business owners?

Business owners who provide ACA-compliant benefits to their employees will now have to cover the difference between last year’s and this year’s affordability threshold.

If an employee makes $40,000 a year, they could only contribute a maximum of $3,932 towards health coverage plans in 2021. That same employee can now only contribute $3,844 per year in 2022. The employer is now responsible for the $88 difference.

The lowered affordability threshold makes healthcare more affordable for employees but will be an additional financial responsibility for employers.

Understand the American Rescue Plan (ARP)

The American Rescue Plan (ARP), created by the Biden Administration, was built to lower insurance premiums for lower and middle-income families. It temporarily reduced the affordability threshold to 8.5%.

These lowered premiums contributed largely to this enrollment season’s record-breaking number of people enrolling in health insurance.

Evaluate Grandfathered Group Health Plans

Health plans are considered grandfathered plans if they existed and have covered at least one person as of March 23, 2010. These plans do not have to comply with certain ACA rules. Some plans may lose their grandfathered status if specific changes are made to reduce benefits or increase costs to employees or dependents.

As a business owner, it’s important to look for those grandfathered plans that may have lost their grandfathered status. Ensure all elements of the plan design remain ACA-compliant. One specific area that grandfathered plans may not include in the latest ACA requirements is preventative services without cost-sharing.

It’s also important to keep records that document the plan’s terms that were in effect on March 23, 2010. This helps to verify existing grandfathered plans.

Review Plan Documents for Changes

Plans undergo changes over time. Review any changes to make sure your plan documents are aligned with any changes– new and old.

All group health plans must:

Ensure waiting periods are met

The waiting period is a period of time that must pass before coverage is effective for an employee or their dependents. This waiting period must not exceed 90 days.

Confirm annual dollar limits are not covering essential health benefits

The essential health benefits are the services that must be covered under the Affordable Care Act. If the plan you’re using limits the number of visits to health providers or limits the days of treatment, you must verify that the visit/day limit does not amount to a dollar limit.

Verify there are not any pre-existing condition exclusions

Exclusions for pre-existing conditions cannot be imposed on any individual, regardless of their age.

Unless there are certain HRAs, make sure there is not an employer payment plan in place.

Lastly, as an employer offering ACA-compliant benefits, it’s important to ensure that there are not any employer payment plans in place. These payment plans are used by an employer to reimburse employees for some or all of the premium expenses for their health insurance policy.

Non grandfathered group health plans must:

Make sure out-of-pocket costs for essential health benefits don’t go over $8,700 for individuals and $17,400 for family coverage.

Give Employees and Dependents Required Notices

Be aware of the required notices employees and their dependents might receive so you are prepared to submit these notices appropriately.

Employees and their dependents must receive the proper notices such as:

- Health insurance exchange notice: written notice related to the Health Insurance Marketplace for all new employees within 14 days of their start date.

- Summary of benefits and coverage: Confirm the contractual arrangement with your carrier to a third-party administrator and any notice of plan changes no later than 60 days prior to the effective date of the change.

Be Aware of “Pay or Play” Responsibilities

ALEs, as mentioned before, are responsible for providing employees with healthcare benefit coverage options. Make sure you know your business’s status as an ALE, and that you are complying with the rules and regulations.

If you know your status as an ALE, revisit the type of group health plan coverage you’ll offer your full-time or full-time equivalent employees

Prepare forms 1094 and 1095

Each year, the IRS requires ALEs to send their employers 1094 and 1095 documents to fill out to make sure their employers are complying with ACA requirements. It also helps the IRS ensure ALEs are offering coverage, and verify the type of coverage they are offering.

The forms for the 2021 calendar year are due in early 2022. Fill them out early and accurately to avoid missing any information.

Learn more about forms 1094 and 1095 here.

Other Updates to Review

Depending on the employer and the health plan, other action item updates might need to be reviewed. The list below outlines certain actions employers might need to take to continue being compliant with ACA regulations in 2022.

- Medicare Tax for High Earners should be withheld (0.9%) from employees who make $200,000 or more in a calendar year

- Monitor the coverage of preventative services guidelines

- Distribute the medical loss ratio rebate as appropriate

- Employers who have certain self-insured health plans must report and pay Patient-Centered Outcomes Research Institute (PCORI) fees by July 31st, 2022

- Report health coverage costs on W-2 forms

- Confirm compliance with Section 1557 Nondiscrimination requirements if applicable.

For more information about ACA compliance, and how to avoid the fines and penalties associated with being uncompliant, read our article, here.

Article originally published on SBMA Benefits.