Innovative HIA makes healthcare affordable by focusing on the insurance needs of people and trimming away the things most people don’t actually want. How do we do it? Let’s discuss.

Innovative HIA Provides Affordable Care Act Compliant Benefits

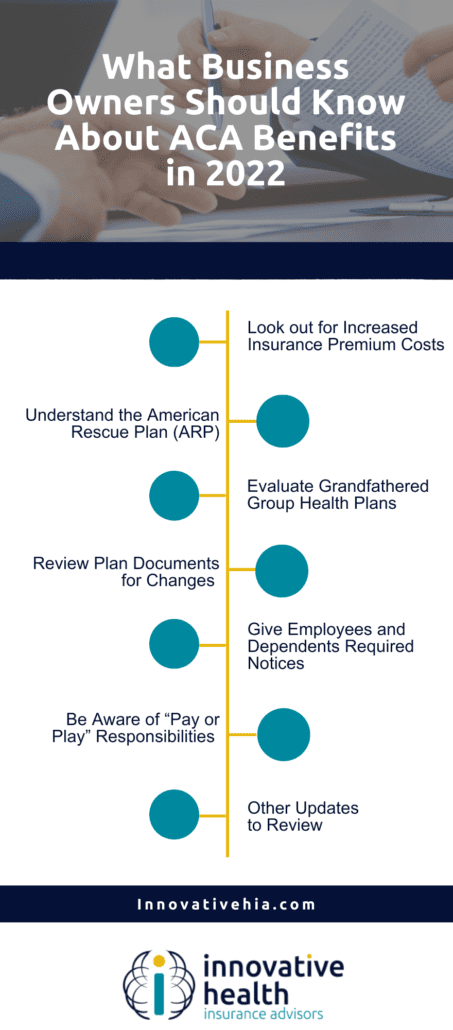

Any ACA-compliant benefit plan must cover these 10 health benefits:

- “Ambulatory services

- Emergency services

- Hospitalization

- Pregnancy, maternity, and newborn care (before and after birth)

- Mental health and substance use disorder services

- Prescription drugs

- Rehabilitative and habilitative services and devices

- Laboratory services

- Preventative and wellness services and chronic disease management

- Pediatric services”

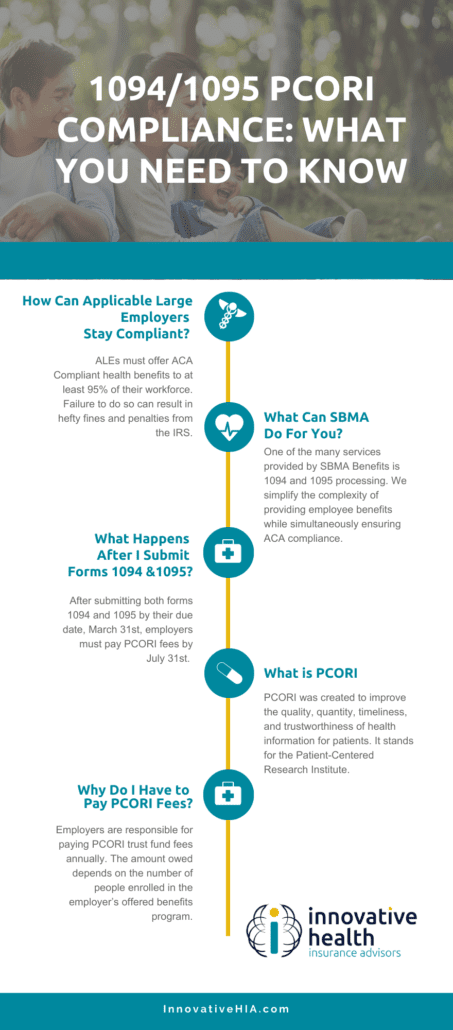

Minimum Essential Coverage (MEC) is a classification of insurance plans that meet the Affordable Care Act requirements for health insurance coverage. Plans that meet MEC requirements include marketplace, job-based plans, Medicare, and Medicaid.

MEC can be a cost-effective way to ensure that families are protected in times of need but employers aren’t overpaying for unnecessary services.

Why Do Employers Need to Offer Coverage?

Employers must offer at least Minimum Essential Coverage (MEC) to any benefit-eligible employee. Non-compliance will generally result in a penalty of $2,750 annually PER eligible employee.

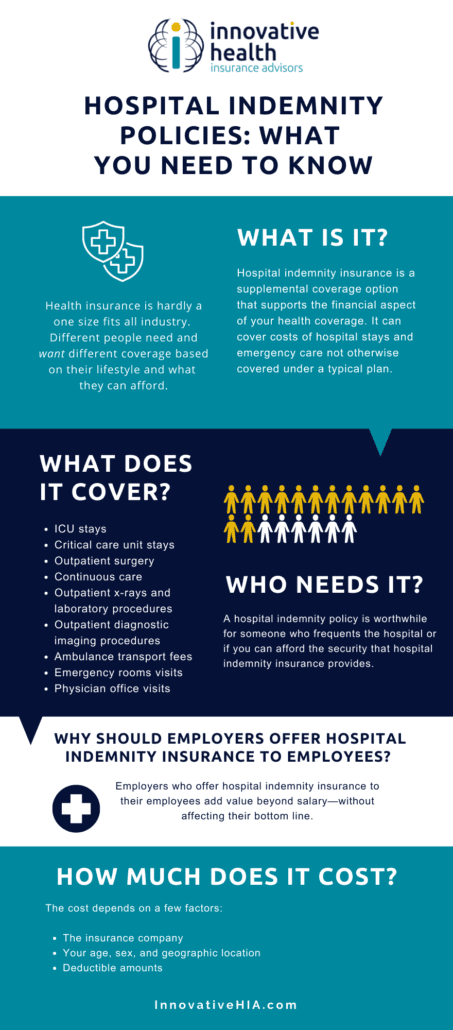

Innovative HIA provides benefits that will meet these requirements and keep employers from being penalized without making them pay for the services they don’t need. We offer affordable coverage for all clients, with a variety of options, including telehealth, vision, and dental voluntary benefits.

How Affordable Are Innovative HIA’s ACA Compliant Plans?

Many of Innovative HIA’s plans cost less than $100/month and include virtual health, worksite benefits, vision, dental, and ACA-compliant plans that are affordable for both employers and employees.

Innovative HIA plans also offer the bundling of medical and ancillary benefit options, making affordable healthcare options easy for employers. This is a significant contrast to many employers paying thousands of dollars a month for major medical coverage.

Let’s Talk Telehealth Services: Giving People Medical Care at the Right Place and Time

Telehealth services experienced a spike in popularity during the COVID-19 pandemic. Why? Telehealth services allow patients to stay home and keep others safe as well as work around a collection of other challenges, such as:

- Problems finding childcare

- Issues driving to or navigating a hospital due to a disability

- Difficulty getting time off work

Innovative HIA’s virtual health and telemedicine services offer plan participants 24/7 access to their doctor, at no cost to them. They can speak to a licensed physician as and when they need, by phone or video, and find the complete solution to their health care needs.

Learn more about telehealth services.

Innovative HIA Gives Users What They Want: Hassle-free, Basic Care

Innovative HIA knows what the users of its insurance want, need, and expect: they want to go to the doctor when they need a check-up, they want to be able to get their kids registered for school with all their shots, and they want doctor visits and prescriptions to be as efficient and hassle-free as possible.

Learn more about Innovative HIA and our benefit plans.

Frank Crivello: Meeting Real-World Insurance Needs to Make Healthcare Affordable For All

Frank Crivello, CEO of SBMA believes that success is not a destination, but a journey. He defines success as the balance of achievement and satisfaction.

“If you don’t like what you’re doing but you have a ton of money, that’s not success. If you do like what you’re doing and don’t have any money, well, that’s not success either,” he says.

Meeting the real-world insurance needs of people

Despite not having gone to Harvard or pursued advanced degrees, Frank achieved success just by learning from everyone around him.

“I’ve absorbed incredible insights and lessons from business owners and co-workers, from janitors and motivational speakers. Innovative HIA is successful because we listen to the needs of our brokers and the companies we serve, and then exceed expectations,” he states.

When Frank first started out in the insurance industry, he noticed that all the third party administrators were offering all kinds of products that their employer groups didn’t want or need. So when he built Innovative HIA, it was specifically to meet the real-world needs of the people they served.

Innovative HIA provides ACA compliant benefits administration for large employers all across the US. The company’s offices and customer care center are located in sunny San Diego, CA.

“Insurance is not a new industry and, to be honest, major medical is not a place where much innovation takes place. At Innovative HIA we saw the opportunity to innovate in the MEC space, and seized the chance to really make a difference,” states Frank.

He notes that SBMA provides affordable coverage for all of its clients, with a variety of options, including telehealth, vision, and dental voluntary benefits. Their revolutionary idea was to offer plan participants real-world benefits they can actually use.

Providing affordable healthcare options for all

Innovative HIA benefit plans provide a complete solution for employers who want to provide affordable benefits to their workers. The firm offers the most competitive limited medical plans in the industry, with seamless benefits that work like major medical, ensuring ACA compliance for the employer at a price they and their employees can afford.

Many of Innovative HIA’s plans cost less than $100/month, and include Virtual Health, Worksite Benefits, Vision, Dental, and ACA compliant plans that both employers and employees can afford.

Innovative HIA plans also offer the bundling benefits of medical and ancillary options, making affordable healthcare options easy for the employers. Frank points out that not everyone wants to pay out thousands of dollars a month for major medical.

“Our benefits provide coverage for those who value acute care, prescription coverage, and regular DR visits, but don’t want to pay for comprehensive major medical. We created healthcare that costs between $40 to $125/month, by carving out the big ticket items to build plans that give people benefits they actually use. Practical, useable, affordable, and ACA compliant benefits for everyday people! That’s our revolution!” he declares.

Frank points out that, prior to the pandemic, the majority of patients preferred in-person doctor visits over telehealth options. However, when a contagious airborne virus appeared, telehealth options expanded dramatically. Almost all health insurance providers now have new, simple-to-use options.

With a Virtual Health medical professional on the line at any time of day or night, nationwide telehealth services help avoid unnecessary doctor visits, and provide numerous financial benefits to both healthcare providers and patients.

Telehealth services can help reduce transportation costs and save money for both patients and providers. Virtual visits aid in increasing patient retention, streamlining time on task, improving appointment compliance, lowering overhead costs, and reducing in-person liability.

Innovative HIA’s virtual health and telemedicine services offer plan participants 24/7 access to their doctor, at no cost to them. They can speak to a licensed physician as and when they need, by phone or video, and find the complete solution to their health care needs.

Flipping the MEC model on its head

Minimum essential coverage (MEC) is an insurance plan that meets the Affordable Care Act requirements for health insurance coverage. Plans under MEC include marketplace, job-based plans, Medicare, and Medicaid.

Prior to the Affordable Care Act, insurers would refuse to insure people with preexisting medical conditions. Those who had used too much of their medical coverage in the past were also at risk of losing it.

MEC ensures that all enrollees have access to insurance, regardless of their health status or the plan they choose. It can be a cost-effective way to ensure that families are protected in times of need. Frank points out that the MEC space has traditionally been filled by those providing minimum essential coverage paired with minimum service.

“We flipped the model on its head by providing gold standard service to accompany the government mandated MEC coverage that employers must offer to be ACA compliant,” he states.

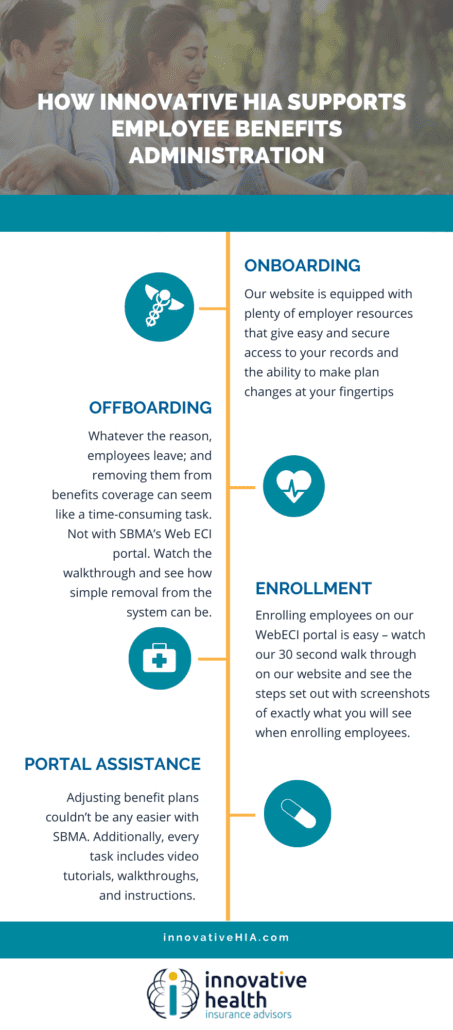

Innovative HIA knows what the users of its insurance want, need, and expect. They want to go to the doctor when they need a check-up, they want to be able to get their kids registered for school with all their shots, and they want doctor visits and prescriptions to be as hassle-free as possible.

Innovative HIA also knows what its employer groups want: Fast enrollment and off boarding, no hassle ID cards, no hassle claims, and coordinated technology that streamlines their experience. And finally, the firm makes brokers’ lives better by taking all the hand-holding off their plates.

Brokers are able to provide employer groups not only with great rates and easy compliance with the ACA requirements, but they can also hand those employer groups off to Innovative HIA, knowing that there will be a gold standard support team handling every phase of their relationship, from the moment the group enrolls.

A respected leader who commands trust and faith

Frank defines his leadership style as casual, collaborative, and authoritative. “Don’t mistake that for authoritarian. I know what needs to be done, and am clear with everyone around me. I move fast, make decisions with certainty, and I pivot easily,” he points out.

As CEO, Frank ensures that Innovative HIA is on track to be the best in the industry. His relationships with the leading brokers keep his finger on the pulse of the industry, allowing Innovative HIA to be more agile, more responsive, and a better partner for its brokers, and employer groups, with the freedom to be the best ACA compliant MEC coverage provider in the industry.

Some of the people on Frank’s leadership team have been with him since the early days, which he feels is a testament to the strength of their trust and faith in him as a leader.

“Nobody gave me anything starting out,” Frank observes. “I had to earn everything from the ground up. That might make some people resentful, but not me. I’m grateful for all the hard work I put in to get here. The view from the top is amazing, especially if you took the stairs.”

Today, SBMA is the industry leader in providing MEC coverage. Over the past five years, the firm has grown to become the gold standard in customer service by building the technology to streamline all of its operations. “I see blue skies and market domination in our future. And, I’m just getting started!” states Frank.

As a father, Frank dotes on his two beautiful daughters who keep him grounded and balanced. “They’re everything to me. Watching them grow up, and creating a life for them where they see that hard work pays off, and that grit and determination is enough to succeed, gives me great satisfaction,” he says.

Frank’s parting advice to aspiring business leaders is to: LISTEN. Don’t let ego get in the way of learning. It’s easy to think you already know, or even to worry that someone will think you’re stupid if you don’t know the answer. Lose that perspective as fast as possible. If you can absorb everyone else’s knowledge and experience around you, you will accelerate your own trajectory to success.