1094/1095 PCORI Compliance: What You Need to Know

Businesses that provide health benefits for their employee workforce must submit the right forms proving that they offered the required benefits. Now that 1094/1095 filing is complete, it’s time to prepare for federally mandated annual PCORI fees. Are you prepared? Let’s discuss 1094, 1095, and PCORI compliance.

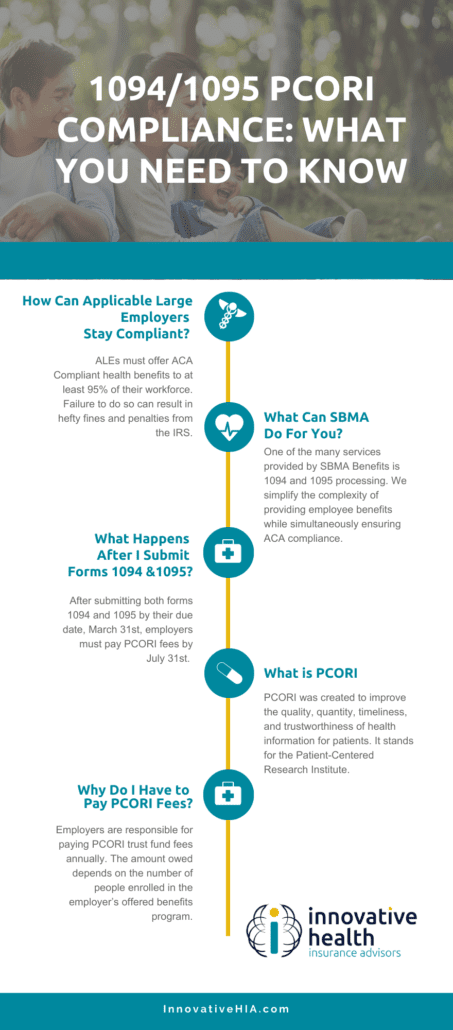

How Can Applicable Large Employers Stay Compliant?

Applicable Large Employers (ALEs), employers with 50 or more full time employees, must offer Affordable Care Act (ACA) compliant health benefits to at least 95% of their workforce. Failure to do so can result in hefty fines and penalties from the Internal Revenue Service (IRS).

The IRS can issue ALEs Penalty A or Penalty B fines for each employee that is not offered correct or compliant benefit plans. Employers can avoid unnecessary fines and penalties by offering ACA Compliant Minimum Essential Coverage (MEC). MEC benefit plans allow employers to provide affordable benefits to their employees without compromising their bottom line.

In order to verify employers are, in fact, offering ACA compliant benefits, the IRS requires employers to fill out form 1094 and 1095.

Employers must complete Form 1094, which is used to determine their liability for payment under the employers’ shared responsiblity provision. Form 1095, however, is used as a summary of healthcare information the ALE offers employees.

What Can Innovative HIA Do For You?

One of the many services we provide at SBMA Benefits is 1094 and 1095 Form processing. We simplify the complexity of providing employee benefits while simultaneously ensuring ACA compliance.

What’s included in our 1094/1095 processing?

- Electronic filing of 1094 and 1095 forms annually

- PDF soft copies of 1095 for employee distribution

- 1095 error corrections refiling (if applicable)

- Mail distribution

What Happens After I Submit Forms 1094 and 1095?

After submitting Forms 1094 and 1095 by their due date, March 31st, employers must pay fees to the Patient-Centered Research Institute (PCORI) by July 31st. This year, however, the due date has been extended to August 2nd since the previously mentioned due date lands on a Saturday.

What is PCORI and Why Do I Have to Pay Their Fees?

PCORI was created to improve the quality, quantity, timeliness, and trustworthiness of health information for patients.

According to the PCORI, its mission is to “help people make informed healthcare decisions, and improve healthcare delivery and outcomes, by producing and promoting high-integrity, evidence-based information that comes from research guided by patients, caregivers, and the broader healthcare community.”

Employers are responsible for paying PCORI trust fund fees annually. The amount employers owe depends on the number of people enrolled in their offered benefits program.

The fee is calculated based on the average number of individuals covered in a benefits plan- including spouses, dependents, retirees, and COBRA participants. Currently, PCORI fees are $2.79 per enrollee. In 2021, PCORI fees cost $2.66 per enrollee.

The fee was slated to end in 2019, but was extended via Trump’s Further Consolidated Appropriations Act of 2020. For now, PCORI fees are extended through 2029.

For more information read our article on what business owners should know about ACA Benefits in 2022.

Article originally published on SBMA Benefits.