Hospital Indemnity Policies: What You Need to Know

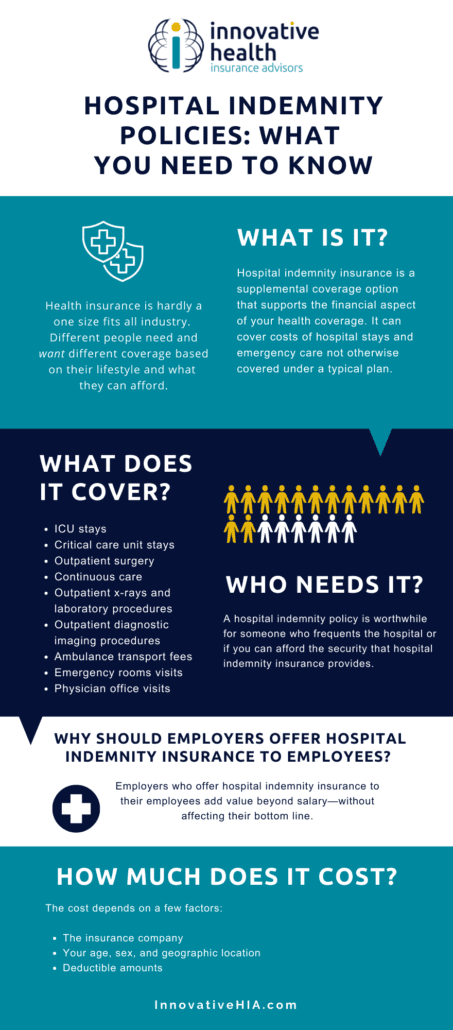

Health insurance is hardly a one size fits all industry. Different people need and want different coverage based on their lifestyle and what they can afford. Based on this and additional personal factors, people choose to enroll in various coverage plans. One policy type that someone might choose to opt into is hospital indemnity coverage. Let’s discuss the details regarding hospital indemnity coverage, who needs it, how much it costs, what it covers, and more.

What is Hospital Indemnity Insurance Coverage?

Hospital indemnity insurance is a supplemental coverage option that supports the financial aspect of your health coverage.

It is intended to cover the costs of hospital stays and emergency care that are not otherwise covered under a typical insurance plan. If you do have to take an unexpected trip to the hospital, you pay a fixed cost, instead.

For example, without this supplemental insurance, if you have to take an unexpected trip to the hospital, you instead pay a fixed cost

Depending on the type of plan you have, hospital indemnity insurance benefits can go toward:

- Deductibles

- Coinsurance

- Transportation

- Medication

- Rehabilitation

- Home care costs

- Various recovery expenses

This coverage can be sponsored by your employer, a government plan, or by a private insurer.

What Does Hospital Indemnity Insurance Cover?

Hospital indemnity coverage may vary slightly from one plan to another. However, it most commonly covers the following:

- ICU stays

- Critical care unit stays

- Outpatient surgery

- Continuous care

- Outpatient x-rays and laboratory procedures

- Outpatient diagnostic imaging procedures

- Ambulance transport fees

- Emergency room visits

- Physician office visits

Generally, plans have lower premiums compared to other insurance, but depending on your coverage, can increase.

Who Needs Hospital Indemnity Insurance Coverage?

The age-old adage, “accidents happen,” is around for a reason.

Accidents can’t be predicted or prevented, hence why they’re accidents. In some cases, however, certain people may be more inclined to need consistent hospital health services.

A hospital indemnity policy is a worthwhile benefit to have for someone who frequents the hospital or if you can afford the security that it provides.

Oftentimes patients may be surprised and overwhelmed by the bills and financial responsibility that follow a hospital stay. At SBMA, we believe it’s better to protect your finances with additional coverage.

Consider this policy for individuals with the following:

- Chronic conditions that can lead to hospitalization (i.e. heart disease)

- Upcoming surgery that could lead to extended hospital stays or care

- Women who are pregnant or expect to become pregnant (the supplemental coverage can cover additional days spent in the hospital after childbirth)

- Peace of mind knowing there is coverage in case of an accident

Although emergency services can create a financial burden, patients can have peace of mind now with the No Surprises Act protecting from surprise medical billing. Read on to learn more about The No Surprises Act.

How Much is Hospital Indemnity Insurance?

There isn’t a fixed cost to this insurance policy. The cost, however, depends on a few factors:

- The insurance company

- Your age

- Your sex

- Your geographic location

- Deductible amounts

Forbes found that on average, hospital indemnity insurance premiums can range from about $50 to $400 a month. Additional research found that the average 3-day hospital stay costs about $30,000.

Is Hospital Indemnity Insurance Worth It?

It depends on who you’re asking.

Investing in hospital indemnity insurance can be worth it—depending on your health, lifestyle, and future plans.

Ask yourself the following when deciding whether or not to add the supplemental insurance to your existing coverage:

- How healthy are you? Consider the likelihood that you or a loved one will become hospitalized.

- What does your current health plan cover? Look at your current healthcare plan to identify what it does and does not cover.

- Can you afford the medical costs if an accident occurs? Forbes found that “over 36 million people in the U.S. are admitted to a hospital every year, many of whom may not be prepared for the cost.”

Answering these questions will help you decide if this additional policy is worth it for you.

Why Should Employers Offer Hospital Indemnity Insurance to Employees?

Employers who offer hospital indemnity insurance to their employees add value beyond salary—without affecting their bottom line.

As employees consider the widening job market available to them, offering a competitive job opportunity that includes healthcare benefits and hospital indemnity can make you an ideal employer that attracts and retains the best employees. After all, 60% of employees rated benefits as very important in contributing to job satisfaction.

Other benefits of offering this supplemental coverage to employees include:

- Increasing employee retention

- Increasing employee productivity

- Increasing teamwork and organization

- Improving overall financial savings for employers and employees

Want to learn more? Read our article “The Difference Between Hospital Indemnity and Accident Insurance” for more information.

Here at Innovative HIA, we offer various comprehensive health care plan options in addition to supplemental coverage options—such as hospital indemnity coverage. For details about our plans or to enroll today, contact us directly or speak with one of our experienced brokers.

Article originally published on SBMA Benefits.